The Solar System consists of the Sun, eight planets, moons, dwarf planets, asteroids, comets, and other celestial objects.The Sun is the center of the Solar System and accounts for 99.86% of its…

India is one of the largest producers of agricultural crops in the world, contributing significantly to the global food supply.Rice is the staple food crop and is grown extensively in the states of…

Importance of Infrastructure DevelopmentInfrastructure serves as the backbone of economic growth and development.Facilitates industrial growth, trade, and investment by providing essential services.…

1. OverviewRenewable energy sources are derived from natural processes that are replenished constantly, such as solar, wind, and bioenergy.These energy sources are critical for reducing dependence on…

1. IntroductionCryptocurrency is a digital or virtual currency that uses cryptography for security.Unlike traditional currencies, cryptocurrencies operate on a decentralized network using blockchain…

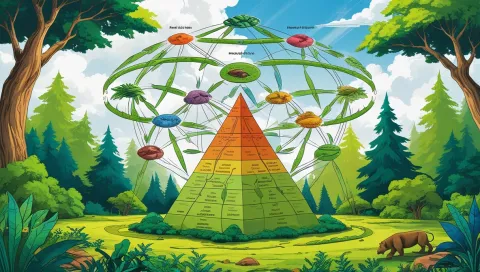

A food chain is a linear sequence of organisms through which energy and nutrients flow in an ecosystem.Food chains start with producers, such as plants, which convert solar energy into chemical…

Aquatic ecosystems are water-based ecosystems where organisms interact with the aquatic environment.They are classified into freshwater and marine ecosystems based on salinity levels.Freshwater…

1. PollutionPollution is the contamination of the environment by harmful substances, affecting air, water, and soil.